Gujpe

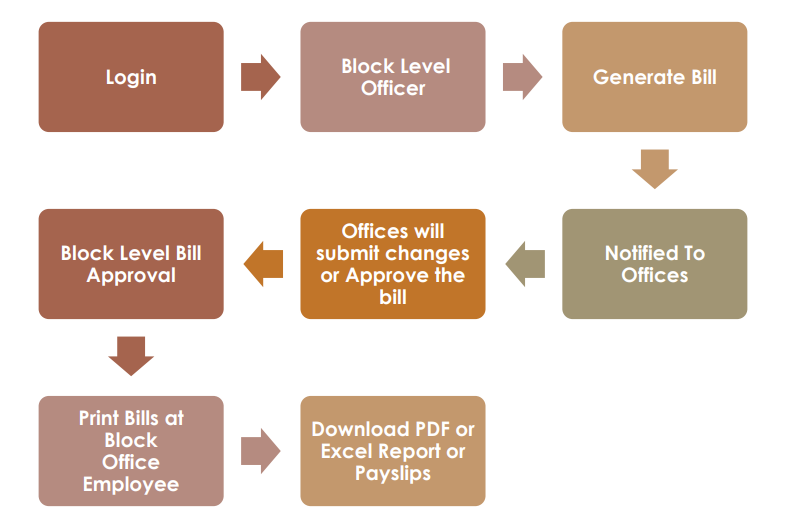

This Gujpe Quick Guide is designed to provide step by step instructions for working in Online Payroll Management System. The hope is that the steps presented in this tutorial will provide you with foundational knowledge that can be built upon later. As the name indicates this is a Quick Start Guide that serves as a launching point for your exploration into GujPe. It will not provide an in depth explanation for the processes involved. For this, you can consult the GujPe Support.

GujPe System Developed for Reduce Paper Work and Consuming Human Hours of Government Employees.

A Payroll System involves everything that has to do with payment of employees and filling of employment taxes.Different Modules are available for employee time-tracking, calculating wages, withholding taxes and other deductions, printing and delivering checks and paying employment taxes to government.